This page describes the accounts of assets on balance sheet.

It emphasizes understanding the meaning of accounts rather than specialized accounting knowledge.

In the balance sheet, assets are listed on the left.

The total amount of assets is called total assets.

- Assets

- It is described "資産", and called "shisan", in Japan.

Assets are the general term for properties that are mainly expected to generate income.

Assets include some properties and rights that do not generate income, but most assets are related to income.

Assets mainly consist of what is needed in the long term or what is generated in the short term, to generate that cash flow.

In equity investment, how much cash flow the company will generate is the important perspective.

- Current Assets

- It is described "流動資産", and called "ryuudou shisan", in Japan.

- Fixed Assets

- It is described "固定資産", and called "kotei shisan", in Japan.

Assets are divided into current assets and fixed assets.

"Current" and "fixed" are like the speed at which money moves.

At the closing date on the balance sheet, "current" means that money is expected to move soon, and "fixed" means that money is not expected to move in the near future.

Specifically, there are two rules that distinguish between current assets and fixed assets: normal operating cycle rule and one-year rule.

According to accounting rules, the account that meet the normal operating cycle rule are first regarded as current assets, and then, the account that meet the one-year rule is also regarded as current assets.

Accounts that do not meet these two rules are included in fixed assets.

- Normal operating cycle rule about assets

-

Assets generated by business transactions, which are the main purpose of a company, belong to current assets.

But, problematic receivables that are clearly not recoverable within one year belong to investments and other assets in fixed assets.

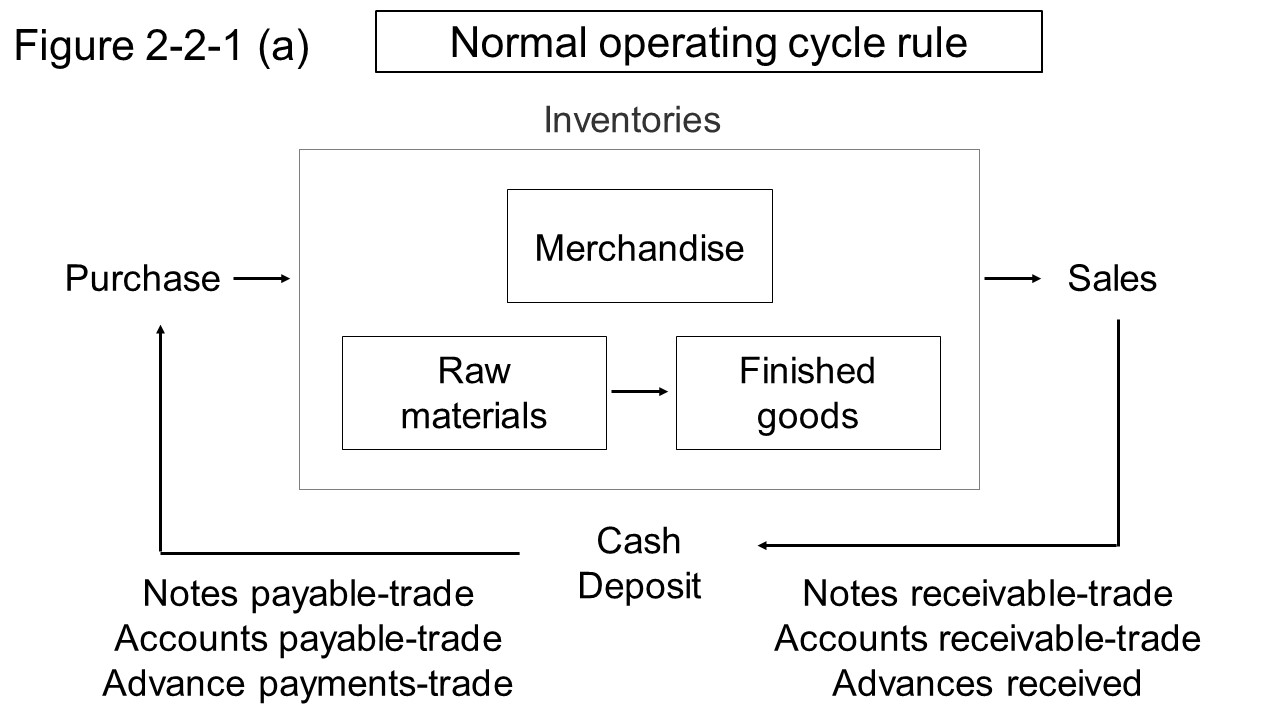

The overview of the normal operating cycle rule is shown in Figure 2-2-1 (a).

Among assets generated in the normal business cycle from purchase to sale, assets that do not have a serious problem belong to current assets.

For example, accounts receivable-trade and finished goods are included in current assets according to this rule.

- One-year rule about assets

- Among the assets generated by transactions other than the main purpose of the company, assets with the term of less than one year shall be current assets, and those with the term of more than one year shall belong to investment or other assets in fixed assets.

Accounts that meet the one-year rule belong to current assets, even if the account does not meet the normal operating cycle rule.

For example, marketable securities, short-term loans receivable, accounts receivable-other, etc.

Accounts of assets are classified into current assets and fixed assets according to the normal operating cycle standard and the one-year standard.

In addition, fixed assets are classified into tangible fixed assets, intangible fixed assets, investments and other assets.

Fixed assets are assets that are not monetized or expensed within a year.

Among them, assets used for business are classified as tangible fixed assets or intangible fixed assets.

Assets with shape belong to tangible fixed assets, and assets without shape belong to intangible fixed assets.

Investment and other assets are assets that are not used for the business itself, but are related to management control, business relationships, and investments over a year.

Current assets are assets that meet the normal operating cycle rule and the one-year rule.

In other words, it is the assets generated by the main business of the company or the assets that will be monetized within one year.

Therefore, current assets include marchandise / products and receivables generated in business activities, or receivables that can be monetized or expensed in the short term.

- Cash and deposits

- It is described "現金及び預金", and called "genkin oyobi yokin", in Japan.

Cash and deposits listed in current assets are cash and deposits that meet the normal operating cycle rule and the one-year rule.

There are various types of deposits such as checking deposits, ordinary deposits, and time deposits, but current assets include only those that can be cashed within one year.

Time deposits with a maturity of more than one year are included in investments and other assets.

It is generally thought that more cash and deposits are better, but when it comes to investing, it is usually unfavorable for companies to hold cash and deposits that they do not plan to use.

What is required of companis is not stock of cash, but cash inflow and its distribution.

- Notes and accounts receivable-trade

- It is described "受取手形及び売掛金", and called "uketori tegata oyobi urikake kin", in Japan.

Notes receivable-trade and accounts receivable-trade are both types of business receivables.

They are also collectively referred to as trade receivables.

When buying and selling between companies, it is often traded with credit without moving cash at the time of buying and selling.

When a company sells goods, etc. with credit, it has the right to receive payment from the other party.

If there is a note as proof of this claim, it is called a note receivable-trade, and if there is no note, it is called an account receivable-trade.

Of course, notes receivable have stronger legal effect.

Both notes receivable-trade and accounts receivable-trade are accounts related to sales from the main business and are included in current assets according to the normal business cycle standard.

Uncollected receivables that are not related to the main business are called non-operating notes receivable or accounts receivable-other.

An increase in notes and accounts receivable-trade means an increase in sales, and it is usually considered desirable.

However, if the increase in sales cannot be collected as cash, working capital will increase and cash and deposits will decrease.

Therefore, when these receivables increase sharply, it is necessary to check the changes in cash flow on the cash flow statement.

- Marketable securities

- It is described "有価証券", and called "yuuka syouken", in Japan.

Marketable securities in current assets is securities for trading purpose or securities scheduled to be processed within one year.

Securities in a general sense are classified into the following four types according to the purpose of holding.

- trading securities

-

Trading securities is the securities aimed at making a profit by buying and selling.

It is described "売買目的有価証券", and called "baibai mokuteki yuuka syouken", in Japan. - Held to maturity (HTM) securities

-

Held to maturity (HTM) securities is the bonds intended to be owned until maturity.

It is described "満期保有目的の債券", and called "manki hoyuu mokuteki no saiken", in Japan. - Shares of subsidiaries and associates

-

Shares of subsidiaries and associates is the shares for the purpose of exercising control or influence.

It is described "子会社及び関連会社株式", and called "ko gaisya oyobi kanren gaisya kabushiki", in Japan. - Available-for-sale securities

-

Available-for-sale securities is the securities that do not fall under the above three.

It is described "その他有価証券", and called "sonota yuuka syouken", in Japan.

Securities included in current assets is only "trading securities", "HTM securities" with a maturity of one year or less, and "available for sale securities" scheduled to be processed within one year of these.

Other securities are included in "investments and other assets" in fixed assets.

Marketable securities of current assets are stocks and bonds whose purpose is to make a profit from fluctuations in market value, and are accounts that are not related to the main business.

- Merchandise and finished goods

- It is described "商品及び製品", and called "syouhin oyobi seihin", in Japan.

A merchandise is an item that is sold without being processed after purchase, and a finished goods is an product that is processed and sold from the purchased material.

Both are included in current assets according to the normal operating cycle rule.

When investing, what kind of products and products the company sells is important.

This is because what is needed by society differs depending on the economic situation.

Stocks that are easily affected by the economy are called economically sensitive stocks, and stocks that are not easily affected are called defensive stocks.

Accounts of merchandise and finished goods is not described on the balance sheet of companies that provide services that cannot be stocked, such as electricity.

- Work in process

- It is described "仕掛品", and called "shikakari hin", in Japan.

Work in process is an unfinished semi-product that cannot be sold yet among the products manufactured by itself.

There are semi-finished products as accounts with the same concept, but semi-finished products are unfinished products that can be sold.

If the semi-product is packaged in the shape to be sold, it is called the product.

If the semi-product is not packaged in the shape to be sold, it is called the semi-finished product.

If it is in the manufacturing process that does not reach the semi-product, it is called the "work in process".

It is an item in the process to a product for sale in the main business, and is included in current assets according to the normal business cycle rule.

- Raw materials and supplies

- It is described "原材料及び貯蔵品", and called "genzairyou oyobi tyozou hin", in Japan.

Raw materials are untouched items that are purchased to make a product.

supplies are, among the items purchased, what not directly related to the manufacture of the product and are in an unused state, or what are directly related to the manufacture of the productat and are some value after use.

The former corresponds to unused stationery and stamps, and the latter corresponds to metal scraps generated in the manufacturing process.

Unused stationery and stamps, etc. correspond to the former, and metal scraps generated in the manufacturing process, etc. correspond to the latter.

Raw materials are included in the business cycle from purchase to sale, and supplies are items that are expected to be monetized or expensed within a year.

Therefore, both are included in current assets.

- Advance payments-trade / Advance payments-other

- It is described "前渡金 / 前払金", and called "mae watashi kin or mae barai kin", in Japan.

advance payments-trade or advance payments-other is an account that indicates that a part or all of the price has been paid when purchasing or outsourcing.

In the case of prepayment, the price is paid in the situation that the goods have not arrived.

Therefore, the balance sheet will be out of balance unless the amount of reduced cash on the asset is recorded somewhere.

Thye are accounts used for temporary processing until the goods and the full amount of the price are exchanged after the goods arrives.

In other words, it can only be treated as an expense after receiving goods or services according to accounting rules (accrual basis).

So, the account which is temporarily counted as an asset until the goods are received is advance payments-trade or advance payments-other.

There is a prepaid expenses as smilar but slightly different account

They are included in current assets according to the normal operating cycle rule.

- Accounts receivable-other

- It is described "未収入金", and called "mi syuunyuu kin", in Japan.

Accounts receivable-other is an account for receiving postpaid money other than "notes receivable-trade and accounts receivable-trade" within the year.

It is included in current assets on a one-year rule.

Uncollected receivables for more than one year other than the main business activities are included in fixed assets as long-term accounts receivable-other.

- Suspense payments

- It is described "仮払金", and called "kari barai kin", in Japan.

Suspense payments are temporarily money paid for what the purpose of use and the amount are uncertain.

For example, if there is an employee who cannot afford the money required for a business trip, the company may temporarily pay the money needed to the employee roughly.

In such a case, the money temporarily paid by the company is suspense payments.

It is assumed to be a temporary payment and is included in current assets on a one-year rule.

- Prepaid expenses

- It is described "前払費用", and called "mae barai hiyou", in Japan.

Prepaid expenses in current assets are prepaid expenses for services received within one year.

prepaid expenses are prepaid costs for services based on certain contracts.

Among the prepaid expenses, the amount of service received within one year is the prepaid expense in current assets.

The portion exceeding one year will be separately recorded as "long-term prepaid expenses" in fixed assets.

The price of the service is an expense, but it cannot be treated as an expense by accrual basis until the service is provided.

In addition, even if the service price is paid in advance, the it is not listed on the balance sheet because service does not remain as a property.

Therefore, expenses that are temporarily counted as assets are prepaid expenses.

- Other

- It is described "その他", and called "sono ta", in Japan.

Other is a collective classification of less important assets and expenses that are not required to be stated in accounting rules.

Those that meet normal operating cycle rule or one-year rule are included in current assets, and those that do not meet them are included in fixed assets.

Fixed assets are assets that are used continuously for more than a year, not for sale.

The meaning of "fixed" is that it is not receibables from a business transaction and there is no plans to dispose it within a year.

Fixed assets are classified into Property, plant and equipment, intangible fixed assets, investments and other assets.

- Tangible fixed assets (property, plant and equipment)

- It is described "有形固定資産", and called "yuukei kotei shisan", in Japan.

Tangible fixed assets are assets with shape among the assets held for long-term use for business activities.

- Buildings and structures

- It is described "建物及び構築物", and called "tatemono oyobi kouthikubutsu", in Japan.

A building is a construction with a roof, walls, or floor built on land for business purposes.

Offices and factories fall under this category.

A structure is a construction installed on the land other than a building and its ancillary facilities.

Paved roads, signboards, fences, gardens fall under this category.

The net amount after depreciation is showed on the balance sheet.

- Machinery, equipment and vehicles

- It is described "機械装置及び運搬具", and called "kikai southi oyobi unpangu", in Japan.

Machinery, equipment refers to machines, apparatus, facilities, etc. acquired for manufacturing and construction necessary for business.

Belt conveyors and bulldozers fall under this category.

Vehicles are commercial vehicles, trucks, railroad vehicles, etc. owned for business purposes.

The net amount after depreciation is showed on the balance sheet.

- Land

- It is described "土地", and called "tothi", in Japan.

Land in tangible assets is the land held for business purposes.

Land for sale is not included in tangible assets and is classified to inventories as a marchandise.

Other land is included in investments and other assets.

Land does not age and is not subject to depreciation.

- Construction in progress

- It is described "建設仮勘定", and called "kensetsu kari kanjyou", in Japan.

Construction in progress is the cost paid in advance for unfinished tangible fixed assets before completion.

When completed, it will be replaced with the tangible fixed assets.

Construction in progress is an expense and is not subject to depreciation because the tangible fixed assets is incomplete.

However, if a problem occurs with the object, it will be subject to impairment.

- Intangible fixed assets

- It is described "無形固定資産", and called "mukei kotei shisan", in Japan.

Intangible fixed assets areassets without shape among the assets held for long-term use for business activities.

Assets such as goodwill, patent rights and software fall under this category.

Intangible fixed assets are amortized evenly by the straight-line method.

- Goodwill

- It is described "のれん", and called "noren", in Japan.

Goodwill is an intangible asset value such as brand or technological capabilities that is expected to show excess profitability.

Goodwill is the additional defference between the purchase price and the market value of the net assets for the acquired company.

When this difference is positive, it can be seen that the acquired company had somewhat intangible value (goodwill) that would result in excess returns.

When the difference is negative, it is called negative goodwill.

Goodwill is amortized by the straight-line method.

- Investments and Other Assets

- It is described "投資その他の資産", and called "toushi sonota no shisan", in Japan.

Investment and other assets are fixed assets that are not included in both tangible and intangible fixed assets.

This includes investment securities (securities held for a long period of time for profit), Stocks of subsidiaries and affiliates, and investments in capital.

In addition, receivables that cannot be monetized within one year, which are considered to be problematic under the normal operating cycle rule, are also included here.

- Investment securities

- It is described "投資有価証券", and called "toushi yuuka syouken", in Japan.

"Investment securities" in fixed assets are securities that do not meet both trading securities and securities scheduled to be processed within one year.

In other words, securities that are not included in marketable securities of current assets are included in investment securities of investments and other assets in fixed assets.

For example, HTM securities with a maturity of more than one year and stocks of affiliated companies.

- Stocks of subsidiaries and affiliates

- It is described "関係会社株式", and called "kankei gaisya kabushiki", in Japan.

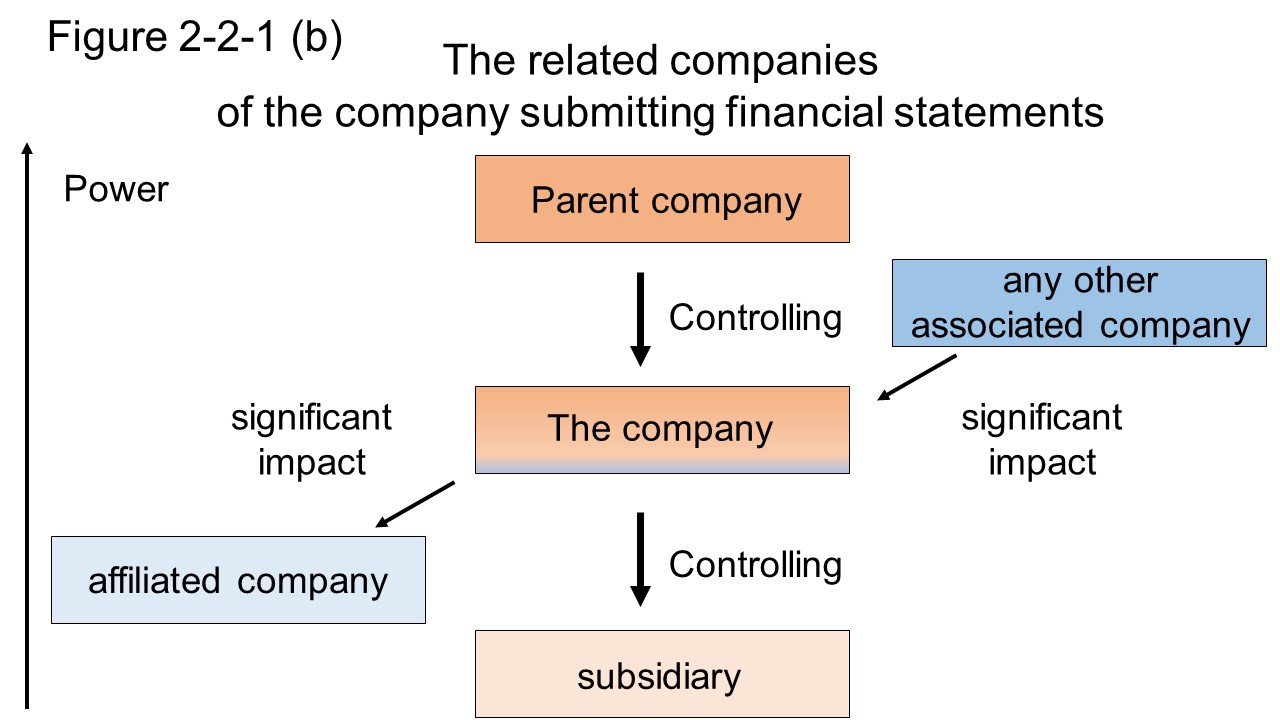

Stocks of subsidiaries and affiliates are stocks of the related companies which include "parent company", "subsidiary", "affiliated company", and "any other associated company".

Parent company is a company that can be regarded as "controlling" the management of a company by satisfying certain conditions.

Certain conditions are, for example, as follows.

- The company owns more than 50% of voting rights alone.

- The company owns 40% to 50% of the voting rights alone, and when combined with the voting rights of close parties, it is over 50%.

Subsidiary is a company that is controlled by satisfying the conditions of the parent company, mainly by ways of occupying 50% or more of the voting rights.

Subsidiaries are subject to the consolidated financial statements of the parent company.

Affiliated company is a company B that company A submitting financial statements can have a "significant impact" by satisfying certain conditions.

Certain conditions are, for example, as follows.

- The company A owns more than 20% of voting rights alone.

- The company A owns 15% to 20% of the voting rights alone, and sends directors to company B.

In principle, the equity method is applied to affiliated companies.

Any other associated company is a company that can have a "significant impact" on a company submitting financial statements by satisfying certain conditions.

In short, a related group consisting of "that company", "parent company", "subsidiary", "affiliated company", and "any other associated company" can be formed from the viewpoint of the company submitting financial statements

Figure 2-2-1 (b) shows the relationship between the companies submitting financial statements and the related companies.

Among the stocks of the related group company, the stock other than that company are stocks of subsidiaries and affiliates.

Stocks of subsidiaries and affiliates are included in investment securities, but individual type of the related company may appear if investment securities are not listed in the investment and other assets section.

- Deferred assets for tax purposes

- It is described "繰延税金資産", and called "kurinobe zeikin shisan", in Japan.

Deferred assets for tax purposes are proof of prepaid tax on differences in recognition between corporate accounting and tax accounting.

Normally, Companis prepare an income statement according to the rules of corporate accounting, which is called corporate accounting principles.

But, the income before income taxes calculated in the income statement does not match the recognition of taxable income under tax law.

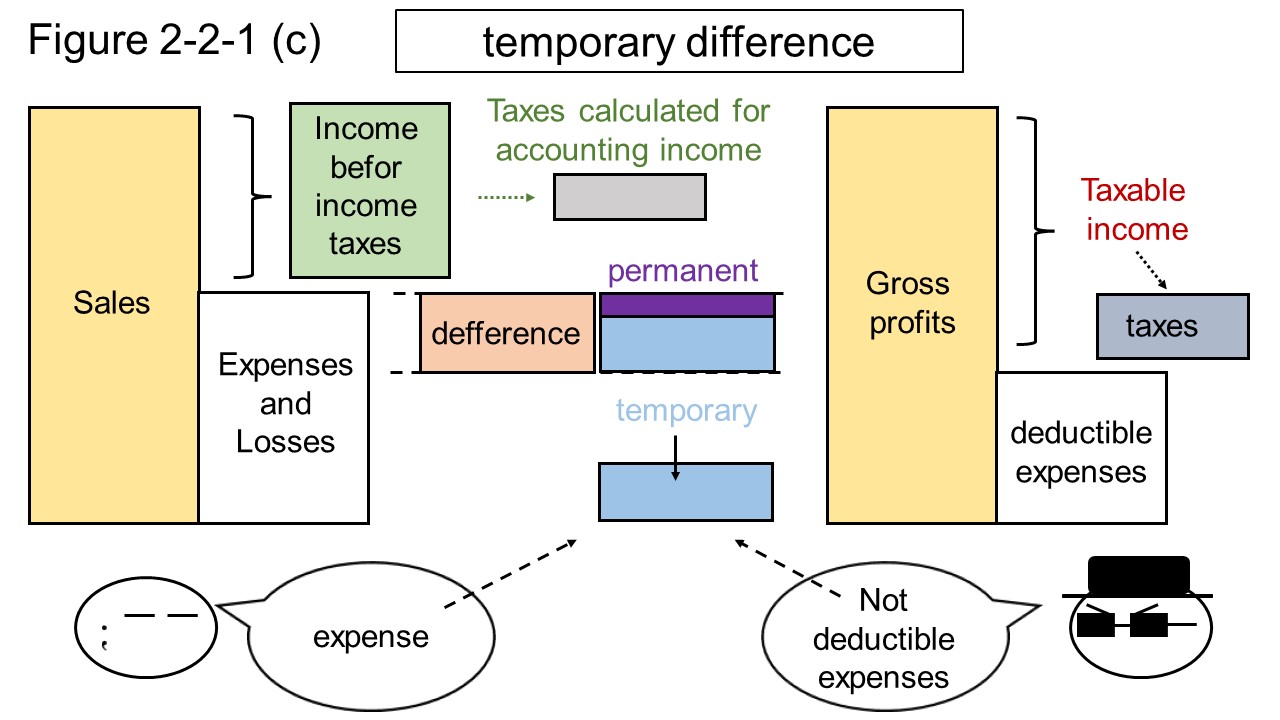

The reason is that accounting income which means profit is calculated by revenues and expenses, while income under tax law is calculated by gross profits and deductible expenses.

This difference in perception can be divided into the "permanent difference" that cannot be permanently filled and the "temporary difference" that is a matter of timing of profit and loss settlement and that the perception eventually becomes the same.

Temporary differences include cases where future taxable income is reduced (future deductible temporary difference) and cases where future taxable income is increased (future taxable temporary difference).

Here, we deal with future deductible temporary differences (hereinafter referred to simply as temporary differences) related to deferred assets for tax purposes.

For example, at the time of recording the allowance for doubtful accounts, the loss has not yet been determined.

And undetermined losses are not recognized as deductible expenses under tax law, and taxable income is greater than income before income taxes under corporate accounting.

As a result, excessive corporate taxes will be levied on small accounting profit, as illustrated in Figure 2-2-1 (c).

Therefore, in order to adjust accounting profit and taxable income, a procedure called tax effect accounting is taken.

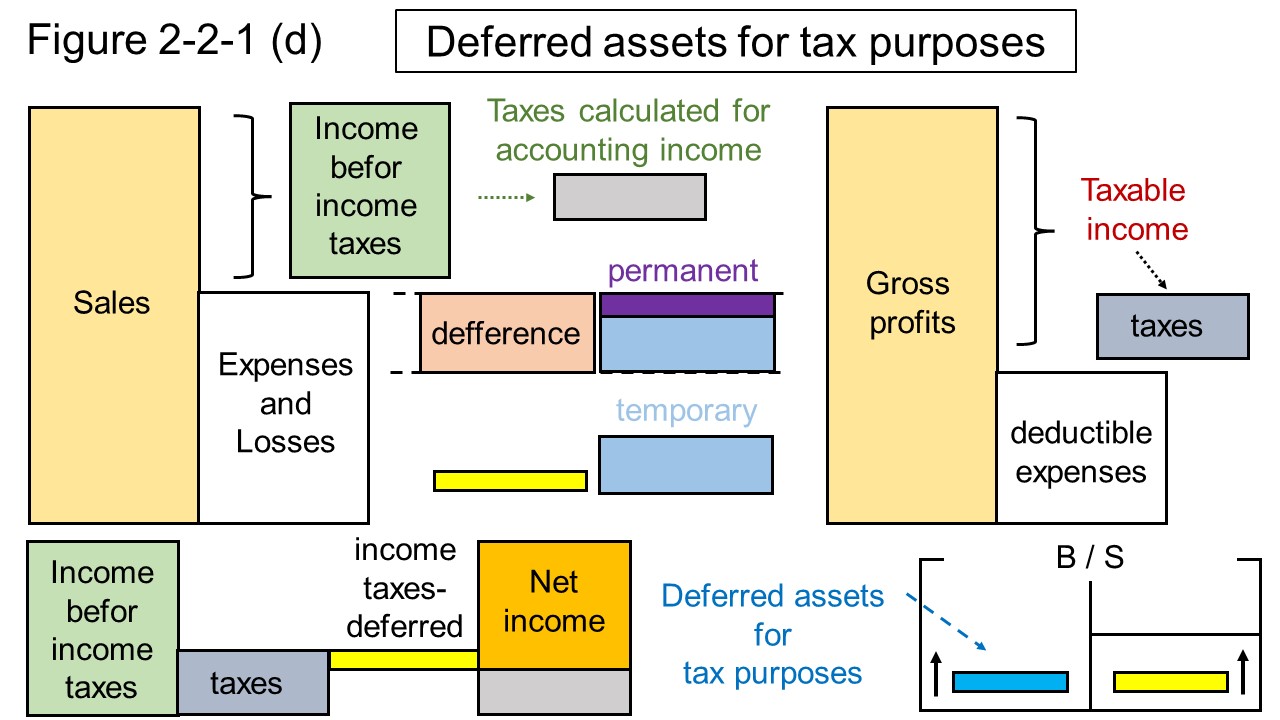

In tax effect accounting, the income taxes-deferred is calculated by multiplying the temporary difference by the effective tax rate.

Then, in the income statement, the income taxes-deferred is substructed from the corporate tax (actually paid tax amount).

At the same time, deferred assets for tax purposes of the same amount as the income taxes-deferred are listed on the balance sheet.

As a result, the situation for the financial statement submitting company is as follows.

- (1) The company pay taxes corresponding to taxable income after accounts closing, including temporary differences (not yet paid at accounts closing).

- (2) The income statement describes the tax (income taxes and income taxes–deferred) corresponding to the accounting profit, and it seems that a reasonable tax has been paid.

- (3) Deferred assets for tax purposes of the same amount as the income taxes–deferred appear on the balance sheet.

(2) means that tax effect accounting was able to inform the business situation (net income corresponding to business performance), which is the purpose of corporate accounting.

(1) and (3) mean that the deferred assets for tax purposes is a proof that the tax has been paid in advance for the temporary difference.

Figure 2-2-1 (d) shows the relationship between the income taxes-deferred and deferred assets for tax purposes.

When the loss is determined, this deferred assets for tax purposes is deleted from the balance sheet, and the amount of income taxes-deferred is added in the income statement.

At this time, small taxes will be levied on the accounting profit that has increased by the amount recorded as a loss in the past, but it looks like that the taxes corresponding to the profit will be levied on the income statement.

And the company don't have to pay the taxes that paid in the past again.

Note that, the deferred assets for tax purposes is a proof that the tax was paid in advance, but it is not a proof that the prepaid tax is refunded.

If the company is in the red when an undetermined loss is confirmed, it means that there is no taxable income in the first place, so there is actually no recognition difference and there was no need to pay taxes in advance.

At this time, the deferred assets for tax purposes is reduced and loses its asset value, which has the effect of pushing up net income, but the paid tax is not returned.