This page describes the accounts on comprehensive income statement.

It emphasizes understanding the meaning of accounts rather than specialized accounting knowledge.

- Comprehensive income statement

- It is described ‘包括利益計算書’, and called ‘houkatsu rieki keisan syo’, in Japan.

Comprehensive income is the portion due to profit and loss transactions among the change in net assets between the beginning and end of the period.

In other words, comprehensive income is the amount of change in net assets from the beginning to the end of the period caused by profit and loss transactions.

The change in net assets is generated by three factors.

The first is determined profit and loss that has been recognized as income or expenses in profit and loss transactions.

The second is undetermined profit and loss that has not been recognized as income or expenses in profit and loss transactions.

The third is the increase or decrease in shareholders' equity due to capital transactions.

The first of these, the determined profit and loss that has been recognized as income or expenses is stated in the income statement.

And, the second undetermined profit and loss is stated in the statement of comprehensive income.

In addition, comprehensive income statement summarizes the determined and undetermined profits and losses.

There is a rule of distinction between capital transaction and profit / loss transaction, and capital transaction and profit / loss transaction are clearly separated.

Therefore, increase or decrease in shareholders' equity due to capital transaction, the third, does not appear in the income statement or comprehensive income statement.

That is, the financial statements that describe the factors that change the net assets due to profit and loss transactions are the income statement and the comprehensive income statement.

Since the aim of this page is to explain the statement of comprehensive income,the increase or decrease in shareholders' equity due to capital transactions will be only briefly touched.

The income statement describes determined profits and losses that are recognized as income and expenses.

And the total of the determined profits and losses is the net profit.

The determined profits and losses here means the profits and losses recognized as income and expense in accounting.

Income statement includes a small amount of valuation gains or losses from market value, but the gains or losses recognized as income or expenses are included in the determined profits and losses.

On the other hand, some profits or losses have not been recognized as income or expenses.

For example, the valuation gains or losses on long-term stocks held for profit are not determined unless they are sold, and they are not stated in the income statement.

However, if they are valued at market value, they will be a factor that causes changes in net assets.

The total of such undetermined profits or losses that are not stated in the income statement but are factors that cause changes in net assets is called other comprehensive income.

In summary, there are two factors that change net assets due to profit and loss transactions: net income and other comprehensive income.

This is expressed by the following formula.

That is, the sum of net income, which is a determined profit or loss, and other comprehensive income, which is an undetermined profit or loss, is comprehensive income.

Comprehensive Income = Net Income + Other Comprehensive Income

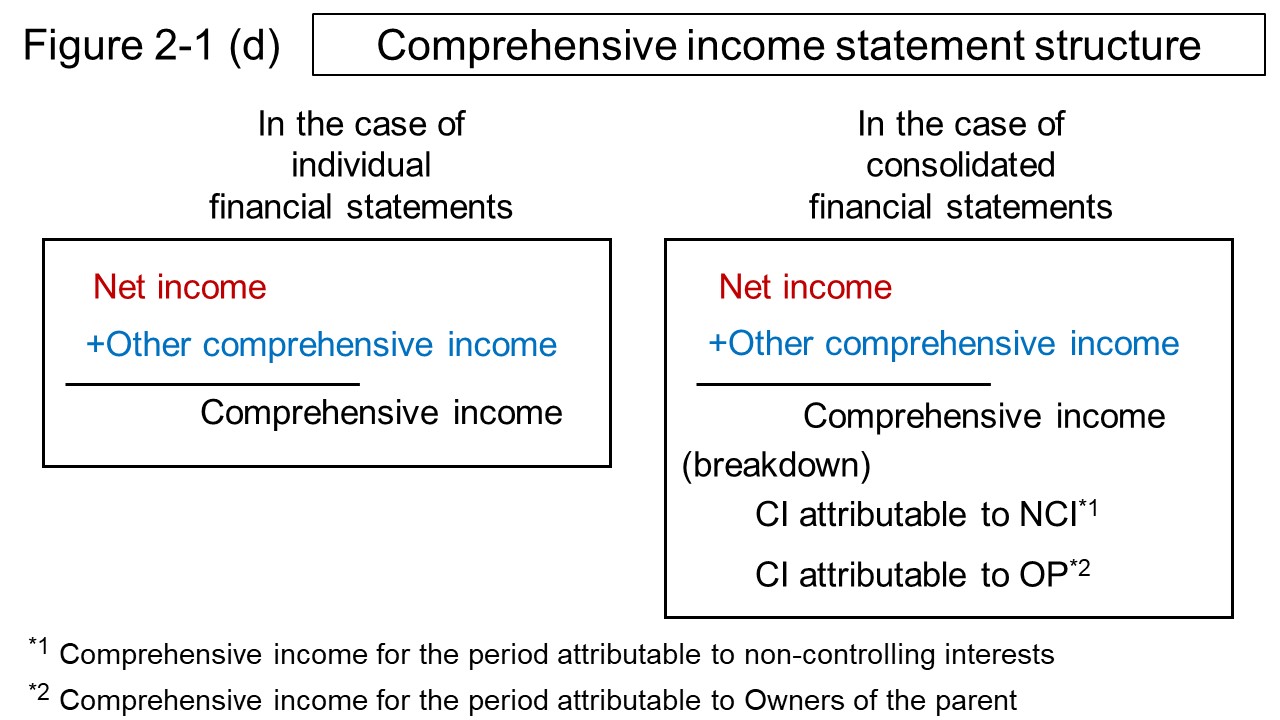

As shown in Figure 2-1 (d), comprehensive income statement has a structure in which comprehensive income is calculated by adding other comprehensive income to the net income.

The individual financial statements and the consolidated financial statements differ only in the description about profits attributable to non-controlling interests.

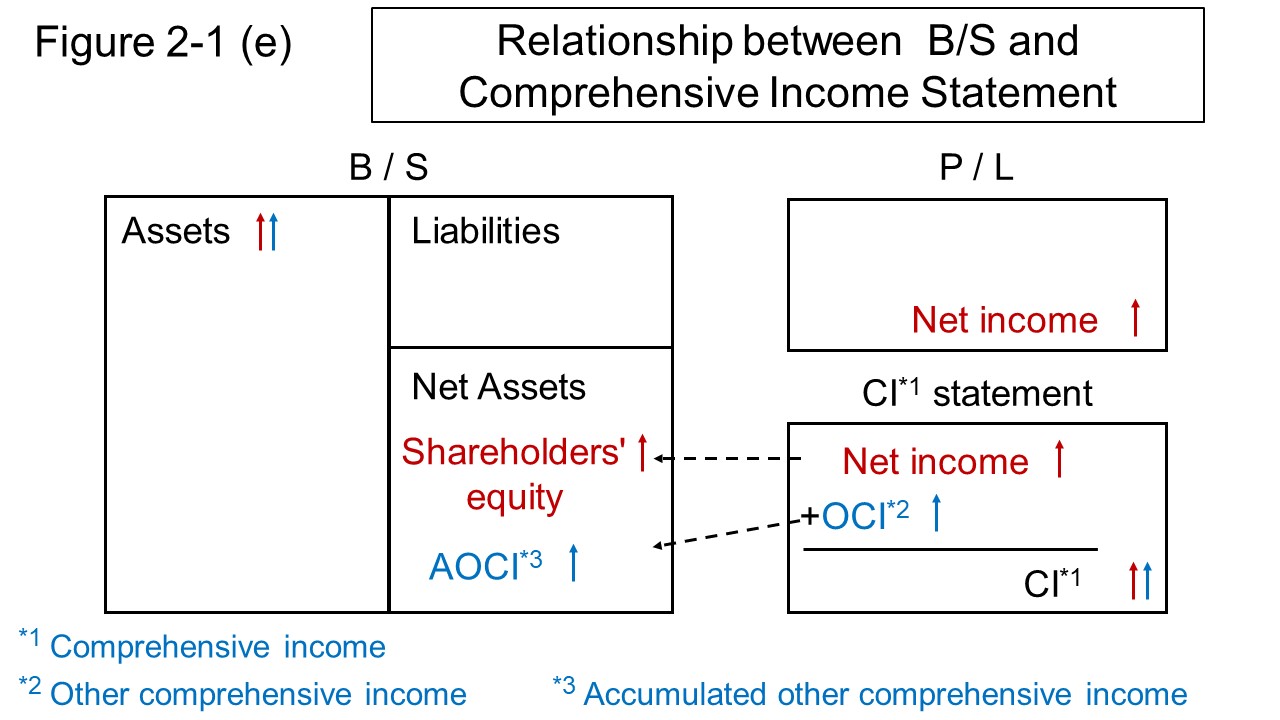

The relationship between the comprehensive income statement and the balance sheet is shown in Figure 2-1 (e).

In the absence of capital transactions, comprehensive income is consistent with changes in net assets over the same period.

By the way, net income is clearly attributed to shareholders, but the attribution of other comprehensive income is a little vague.

In the consolidated income statement, the attribution of net income is stated as ‘net income attributable to owners of the parent company’, in Japanese.

On the other hand, in the consolidated comprehensive income statement, the attribution of comprehensive income is stated as ‘comprehensive income related to the shareholders of the parent company’, in Jpanese.

This indicates that the attribution of other comprehensive income is ambiguous.

However, comprehensive income is generally regarded as profit related to the owners of the parent company.

Finally, the changes in net assets due to capital transactions will be briefly explained.

Capital transaction is a factor of change in net assets, but it do not appear in the income statement or comprehensive income statement.

Profit and loss from capital transaction is described in the ‘Statements of Changes in Net Assets’ under Japanese GAAP, and in the ‘Statements of Changes in Equity’ under IFRS.

Changes in net assets due to capital transactions appear in capital stock or capital surplus in shareholders' equity.

Therefore, if you look at the capital stock or capital surplus in the statements of changes in net assets, you can confirm about the capital transaction.

By the way, net income, which is a determined profit and loss, changes retained earnings in shareholders' equity.

On the other hand, other comprehensive income, which is an undetermined profit and loss, does not affect shareholders' equity and is included in the accumulated other comprehensive income.

Based on the above, the accounts in the comprehensive income statement will be described below.

Comprehensive income consists of net income and other comprehensive income, as described above.

Of these, net income is calculated on the income statement, and other comprehensive income is calculated on the comprehensive income statement.

Then, in the comprehensive income statement, net income and other comprehensive income are totaled to obtain comprehensive income.

At the top of the statement of comprehensive income, the net income obtained from the income statement is stated.

As already mentioned, net income is a determined profit that has been recognized as income and expenses among comprehensive income.

- Other comprehensive income

- It is described ‘その他の包括利益’, and called ‘sonota no houkatsu rieki’, in Japan.

Factors that change net assets include net income which is the result of profit and loss transactions, unrealized valuation gains and losses, and capital transactions.

Other comprehensive income is the undetermined valuation profit and loss among the amount of change in net assets due to profit and loss transactions.

In other words, of comprehensive income, profit other than net income is other comprehensive income.

Comprehensive income = Net income + Other comprehensive income

Other comprehensive income includes the following, all of which have uncertain profits and losses and change in amount over time.

- Valuation difference on available-for-sale securities

- Foreign currency translation adjustment

- Remeasurements of defined benefit plans

- Deferred gains or losses on hedges

Other comprehensive income includes income distributed to non-controlling interests.

Comprehensive income attributable to owners of the parent and non-controlling interests is listed separately after the comprehensive income.

Accumulated other comprehensive income on the balance sheet is the accumulation of other comprehensive income on the income statement, but when assets is sold, it is excluded from comprehensive income and added to net income.

- Valuation difference on available-for-sale securities

- It is described ‘その他有価証券評価差額金’, and called ‘sonota yuuka syouken hyouka sagaku kin’, in Japan.

Available-for-sale securities are securities that do not fall under any of trading securities, held to maturity securities, subsidiary stocks, and shares of subsidiaries and associates.

For example, stocks held for a long period of time for profit and stocks of other companies for strengthening business relationships do not fall under any of the above three, and are therefore classified as available-for-sale securities.

Since Available-for-sale securities need to be evaluated to market value at the closing, the total assets change at each settlement, and the net assets also change accordingly.

The account that records this change is the valuation difference on available-for-sale securities..

The difference from the acquisition cost is stated in the valuation difference on available-for-sale securities on the balance sheet, while the difference from the reference period is stated in the valuation difference on available-for-sale securities on the statement of comprehensive income.

The reference period depends on the method chosen for accounting (washing method or cutting method).

- Deferred gains or losses on hedges

- It is described ‘繰延ヘッジ損益’, and called ‘kurinobe hedge son eki’, in Japan.

Deferred gains or losses on hedges in the comprehensive income statement is the gain or loss of the hedging means in the applicable accounting period.

Accumulated deferred gains or losses on hedges on the comprehensive income statement is the deferred gains or losses on hedges listed in the net assets of the balance sheet.

- Foreign currency translation adjustment

- It is described ‘為替換算調整勘定’, and called ‘kawase kansan tyousei kanjyou’, in Japan.

Foreign currency translation adjustment is an account for adjusting the defference due to the use of multiple exchange rates when converting the financial statements of overseas subsidiaries into yen.

The account that adjusts the defference of the corresponding accounting period is foreign currency translation adjustment of the comprehensive income statement, and the cumulative total is foreign currency translation adjustment of the balance sheet.

- Remeasurements of defined benefit plans

- It is described ‘退職給付に係る調整額’, and called ‘taisyoku kyuuhu ni kakaru tyousei gaku’, in Japan.

Remeasurements of defined benefit plans is an account that adjusts for differences caused by counting retirement benefits using different calculations in the individual and consolidated financial statements.

The accumulation of remeasurements of defined benefit plans in the comprehensive income statement is the remeasurements of defined benefit plans on the balance sheet.

- Comprehensive income

- It is described ‘包括利益’, and called ‘houkatsu rieki’, in Japan.

Factors that change net assets include net income which is the result of profit and loss transactions, unrealized valuation gains and losses, and capital transactions.

Comprehensive income is the change of net assets other than capital transactions with shareholders such as capital increase, dividends, share buybacks, stock acquisition rights, etc. among the change of net assets.

In other words, if there is no capital transaction, comprehensive income is the difference between net assets on the balance sheet of the previous term and the current term.

Comprehensive income consists of net income and other comprehensive income.

Comprehensive income = Net income + Other comprehensive income

Comprehensive income includes income attributable to non-controlling interests.

By the way, comprehensive income under Japanese GAAP was introduced to be consistent with IFRS.

- Comprehensive income attributable to owners of the parent

- It is described ‘親会社株主に係る包括利益’, and called ‘oya gaisya kabunushi ni kakaru houkatsu rieki’, in Japan.

- Comprehensive income attributable to non-controlling interests

- It is described ‘非支配株主に係る包括利益’, and called ‘hi shihai kabunushi ni kakaru houkatsu rieki’, in Japan.

A non-controlling interest are shareholders of a subsidiary other than the parent company.

Comprehensive income attributable to shareholders of the parent company is the profit attributable to the parent company among the comprehensive income of the subsidiary.

Comprehensive income attributable to non-controlling interests is the profit attributable to non-controlling interests among the comprehensive income of the subsidiary.