The purpose of this page is to explain the indicator about effective use of capital among the indicators used in the analysis of companies and stocks.

Return on Equity (ROE) is the value obtained as the net income devided by equity capital.

ROE = Net Income Equity Capital

When ROE is showed by a company, the average of eqyity capital at the beginning and end of the period is used as the equity capital of the denominator.

The reason is that net income is the profit of the period, while equity capital is the amount at a certain point in time, and the average of the period is considered to be more suitable as the denominator.

In addition, in the ROE calculation of the parent company, net income attributable to shareholders of the parent is used as net income.

Since ROE changes largely depending on the net profit of each year, it is difficult to determine the capital efficiency of a company from the ROE of a single year alone.

Therefore, it is better to use the several years average as a measure for the capital efficiency of a company.

ROE is described in the securities report as "自己資本利益率" or "親会社所有者帰属持分当期利益率" in Japanese.

Depending on the company, it is also stated in the earnings report, in which case ROE is stated as "自己資本当期純利益率" in Japanese.

There are various names in Japanese, but all of them mean ROE, and when publishing financial reports in English, ROE is usually written as "Return on equity".

ROE is an indicator for measuring the capital efficiency of the company, which shows the rate of return generated by the company in the current period with respect to the equity capital attributable to shareholders.

Companies with high ROE on average can be expected a virtuous cycle in which an increase in equity capital leads to a further increase in net income.

Therefore, ROE is also regarded as an important indicator for equity investment.

It is often determined that companies with ROE above the cost of capital (about 8%) have generated corporate value, and companies with ROE below the cost have lost corporate value.

ROE is calculated based on net income and equity capital.

Therefore, ROE will improve not only by increasing net income but also by decreasing equity capital.

For example, it is the case that a company's buyback of the treasury stock reduces its equity capital.

If a company has bought back the treasury stock as a appropriation of profits, the improvement in ROE is often favored in the market.

This is because the company is considered to have returned cash that it does not plan to use, to shareholders.

On the other hand, ROE will improve even if a company has bought back its treasury stock by borrowing.

However, buybacks of the treasury stock by borrowing is not permanently sustainable, so even if ROE improves in this case, it may not be considered a reasonable management decision.

ROE depends not only on the net income as a result of the business, but also on the equity capital that can be manipulated intentionally.

Therefore, ROIC is often used instead of ROE as an indicator to measure capital efficiency (described later).

However, if you pay attention to the problems, ROE will be a useful indicator of capital efficiency.

Here, an example of ROE calculation is shown using the following balance sheet and income statement.

The two balance sheets are the results at the end of the previous fiscal year and the end of the current fiscal year.

The income statement has been prepared at the end of the current period.

The unit of the amount is 1 billion yen for both the balance sheet and the income statement.

| At end of previous period | At end of current period |

|

Assets ・・・ |

Assets ・・・ |

| Total assets | Total assets |

|

Liabilities ・・・ Total liabilities Net assets Shareholders' Equity 1,350 Accumulated other comprehensive income 150 Subscription rights to shares 5 Non-controlling interests 35 Total net assets 1,540 |

Liabilities ・・・ Total liabilities Net assets Shareholders' Equity 1,450 Accumulated other comprehensive income 250 Subscription rights to shares 5 Non-controlling interests 40 Total net assets 1,745 |

| Total liabilities and net assets | Total liabilities and net assets |

|

Net sales ・・・ Net income 165 Net income attributable to non-controlling interests 5 Net income attributable to shareholders of the parent 160 |

In the ROE formula, the net income attributable to shareholders of the parent is used as the numerator, and the average of equity capital at the beginning and end of the current period is used as the denominator.

First, by summing up shareholders' equity and accumulated other comprehensive income, the equity capital at the beginning and end of the current period is calculated, respectively.

Equity capital can be also calculated by excluding subscription rights to shares and non-controlling interests from total net assets.

Therefore, according to the following calculation, the average of equity capital at the beginning and the end of the current period is 1,600 billion yen.

ROE can be calculated by dividing net income attributable to owners of the parent by the average of equity capital at the beginning and end of the current period.

Therefore, in this example, ROE is 0.1, which is 10% as a percentage.

Return on Assets (ROA) is the value obtained as the net income devided by total assets.

ROA = Net Income Total Assets

When ROA is showed by a company, the average of total assets at the beginning and end of the period is used as the total assets in the denominator.

In addition, in the calculation of ROA of the parent company, net income attributable to owners of the parent is used as net income.

The reason is the same as for ROE.

Since the amount of total assets and total capital is the same, the return on assets can be rephrased as the return on total capital.

ROA = Net Income Total Capital

ROA is an indicator for considering how effectively a company has used its assets in order to make a profit.

If ROA is regarded as return on total capital, ROA can be cosnidered to be an indicator for judging how effectively a company has used total capital.

Assets include various accounts of different nature.

Therefore, altough ROA is an abbreviation for return on assets, if it is regarded as return on total assets, it will be easier to understand ROA in relation to ROE.

ROE represents the efficiency of equity capital alone in total capital, while ROA represents the efficiency of total capital as a whole.

And a company with a high ROA can be considered to be making a high profit with a small amount of capital or a high profit with a small amount of assets.

ROA levels deffer from industry to industry.

From the perspective of total assets, this is because the asset composition differs for each industry depending on the need for expensive equipment and the nature of the items to be sold, and the average rate of return for each industry also changes due to competitive environment.

From a total capital perspective, there are also differences in the average debt-to-equity ratio between industries.

Therefore, ROA should be used for comparison in the same industry.

Here, an example of ROA calculation is shown using the following balance sheet and income statement.

The two balance sheets are the results at the end of the previous fiscal year and the end of the current fiscal year.

The income statement has been prepared at the end of the current period.

The unit of the amount is 1 billion yen for both the balance sheet and the income statement.

| At end of previous period | At end of current period |

|

Assets ・・・ |

Assets ・・・ |

| Total assets 1,960 | Total assets 2,040 |

|

Liabilities ・・・ Net assets ・・・ |

Liabilities ・・・ Net assets ・・・ |

| Total liabilities and net assets 1,960 | Total liabilities and net assets 2,040 |

|

Net sales ・・・ Net income 102 Net income attributable to non-controlling interests 2 Net income attributable to shareholders of the parent 100 |

In the ROA formula, the net income attributable to shareholders of the parent is used as the numerator, and the average of total assets at the beginning and end of the current period is used as the denominator.

First, it is necessary to calculate the average of total assets at the beginning and the end of the period.

Then, ROA can be obtained by the following calculation.

Therefore, in this example, ROA is 0.05, which is 5% as a percentage.

The right side of the balance sheet can be broadly divided into interest-free debt, interest-bearing debt, and net assets.

Interest-free debt includes debt such as notes and accounts payable-trade and accounts payable-other, and interest-bearing debt includes debt such as short-term loans payable and long-term loans payable.

The lender of the debt is the creditor, and the funder of the shareholders' equity included in the net assets is the shareholder.

And every cash supplier to the company demands a certain return.

Since the lenders of interest-free debt such as accounts payable have already sold their items to the company with additional profit, the company has paid them the required returns from the beginning.

Therefore, it is the cash suppliers of shareholders' equity and interest-bearing debt that companies will have to pay returns in the future.

The cost of capital is the cost to the cash suppliers associated with the financing of the company, which corresponds to the return required by the suppliers of shareholders' equity and interest-bearing debt.

These cost of capital are called the cost of equity and the cost of debt, respectively.

Cost of Capital = Cost of equity + cost of debt

Cost of equity is the return required by shareholders, which is corresponds to the expected rate of return.

Cost of debt is the return required by creditors, which is corresponds to the interest rate on interest-bearing debt.

The weighted average cost of capital (WACC) of the main subject is the cost of capital calculated by weighted average of cost of equity and cost of debt, which is defined by the following formula.

Interest is recognized as a tax loss and has a tax-saving effect, so the term related to the cost of debt is discounted by the effective tax rate.

In addition, shareholders demand a return on market value, so E in the formula below should be counted at market value.

WACC = Re × E E + D + Rd × D E + D × (1 − T)

Re : Cost of equity Rd : Cost of debt

E : Market capitalization D : Interest-bearing debt

T : Effective tax rate

To be precise, the amount of interest-bearing debt should also be counted at market value, but this website substitutes it at book value.

In the case of securities report based on Japanese GAAP, the market value of accounts related to interest-bearing debt is described in "Fair value of financial instruments".

But, the market value of interest-bearing debt is usually not much different from the book value.

From a corporate perspective, WACC is the cost a company needs to finance, and the company have to gain a return more than WACC from the business.

On the other hand, from a shareholder's point of view, companies are reducing the value of their stocks unless they make the rate of return over WACC.

For these reasons, WACC is also called the hurdle rate.

In the calculation of WACC, the value obtained by the model called CAPM (Capital Asset Pricing Model) is used as the cost of equity, and the 10-year government bond yield is used as the cost of debt.

However, it is not easy for individual investors to calculate the cost of equity for individual companies using the CAPM formula.

In practice, it would be better to use 8% ROE, which is used as the basis for determining the creation or destruction of shareholder value, as the cost of equity.

Although it is a rough estimate, if 0% of the 10-year government bond yield, 6% of the average return of stocks in Japan and 1.3 is used as the risk-free rate, market risk premium, and β in CAPM formula, respectively, the expected rate of return will be about 8%.

This expected rate of return corresponds to the cost of equity.

CAPM formula :

Expected Rate of Return on individual stocks = Risk-Free Rate + β × Market Risk Premium

Then, if 8% and 0% is used for the cost of equity and cost of debt, respectively, WACC is 8.0% for the company without interest-bearing debt and 6.4% for companies with the ratio of "market capitalization: interest-bearing debt = 8: 2".

In reality, the cost of equity is higher in industries with larger stock price fluctuations, as represented by β in the CAPM formula. Since the magnitude of stock price fluctuations reflects business instability, the cost of equity tends to be higher for companies that operate unstable businesses.

WACC can be used for management evaluation by using it in combination with ROIC, which will be described later.

In addition, WACC is used as a discount rate in the DCF method.

Here, an example of WACC calculation is shown using the following balance sheet and income statement based on Japanese GAAP.

The unit of the amount is 1 billion yen for both the balance sheet and the income statement.

And here, this company will be assumed to have a market capitalization of 1 trillion yen and an effective tax rate of 30%.

|

Assets ・・・ |

Liabilities Current Liabilities ・・・ Short-term loans payable 100 Current portion of long-term loans payable 50 Lease obligations 5 ・・・ Fixed liabilities Bonds payable 35 Long-term loans payable 300 Lease obligations 10 ・・・ |

|

Net assets ・・・ |

|

|

Total assets |

Total liabilities and net assets |

|

Net sales ・・・ Non-operating expenses Interest expenses 5 ・・・ |

First, the interest-bearing debt will be calculated from the balance sheet.

If it is a securities report of a company that adopts Japanese GAAP, the debt included in interest-bearing debt is also described in "Detailed schedule of bonds payable" and "Detailed schedule of borrowings".

As explained on another page, this website uses the following formula to calculate interest-bearing debt.

Interest-bearing debts ≈ loans payable + commercial papers + Bonds payable + lease obligations

Applying the accounts included in the interest-bearing debt on the balance sheet to this formula, it becomes as follows.

Therefore, interest-bearing debt is 500 billion yen.

Next, the interest rate on interest-bearing debt is estimated.

Interest expenses on the income statement represents the amount of interest paid on interest-bearing debt.

In this example, the interest expense is 5 billion yen, so the interest rate on interest-bearing debt can be roughly calculated by the following formula.

Therefore, the interest rate on interest-bearing debt in this example is 1.0%.

In detail, interest expense is the expense incurred during the period and interest-bearing debt is the amount at the end of the period.

Therefore, more accurately, it is better to use the average of the beginning and end of the period for interest-bearing debt as the denominator.

Finally, apply the numbers required for the WACC formula.

Here, 8% is used as the cost of shareholders' equity.

Therefore, the WACC in this example is 5.8%.

Return on Invested Capital (ROIC) is the value calculated as NOPAT devided by the invested capital, which is defined by the following formula.

ROIC = NOPAT Invested Capital

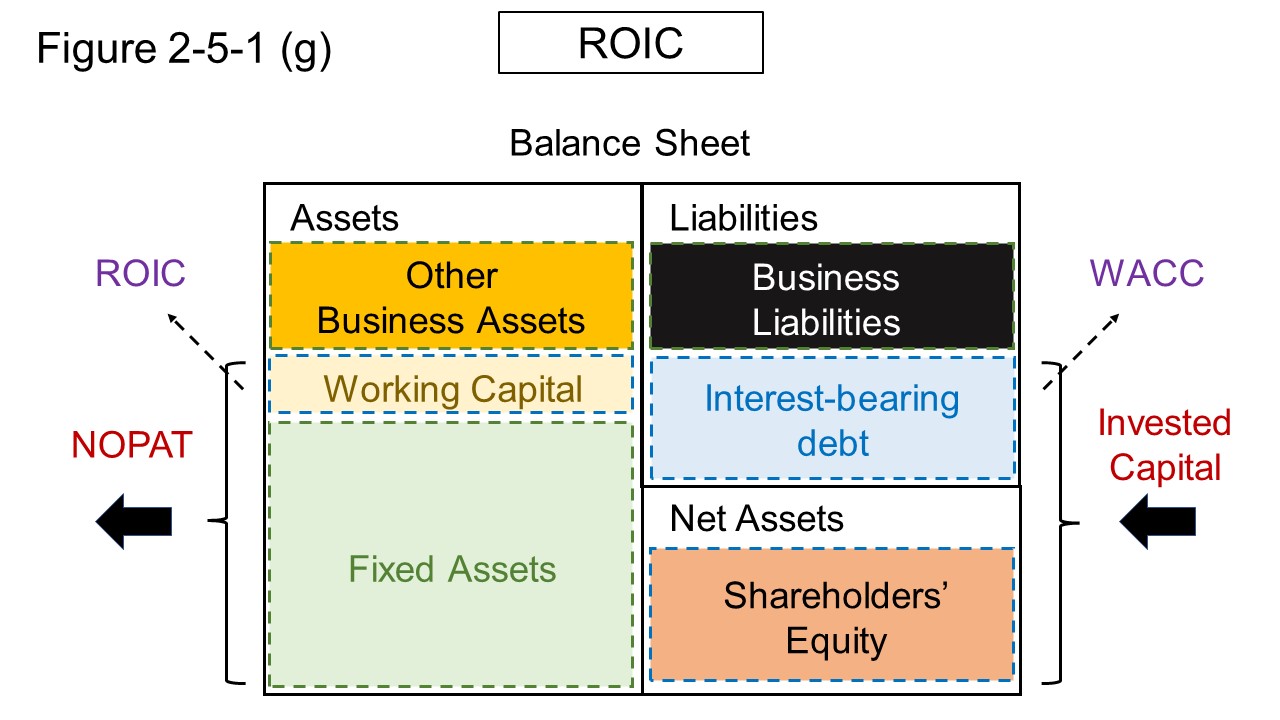

First, the invested capital will be explained here.

There are two perspectives on investment capital.

The invested capital from the perspective of financing is shareholders' equity and interest-bearing debt, as book value.

The invested capital from the perspective of operating is fixed assets and working capital.

An overview of invested capital and ROIC is shown in Figure 2-5-1 (g).

The invested capital from the perspective of financing consists of shareholders' equity and interest-bearing debt on the right side of the balance sheet in Figure 2-5-1 (g).

On the other hand, the invested capital from the perspective of operating consists of fixed assets and working capital on the left side.

Companies use the financed capital to purchase fixed assets and cover the working capital.

And, as a result of the business, assets such as various products and receivables, or liabilities such as accounts payable are generated.

Therefore, whether it is from perspective of financing or operating perspective, invested capital is the first thing that is needed to do business, which creates something.

On the other hand, the portion other than the invested capital is the thing that is created in the process of business.

Below, ROIC will be explained in terms of invested capital from the perspective of financing.

As mentioned above, the invested capital from the perspective of financing is shareholders' equity and interest-bearing debt, as book value.

Then, as shown in Figure 2-5-1 (g), the company operates business using these two financed money, and NOPAT is generated as a profit.

Therefore, if the above ROIC formula is rewritten using the invested capital from the perspective of financing, it becomes the following formula.

ROIC = NOPAT Shareholders' equity + Interest-bearing debt

That is, ROIC is the rate of return after tax on the investment capital of shareholders and creditors, other than the balance of interest.

Simply put, ROIC is an indicator of how much money a company has made with the money financed.

If a lot of capital is invested, it is natural that NOPAT will increase.

However, unless the invested capital is effectively utilized, ROIC will not increase even if NOPAT increases.

Therefore, ROIC can be considered to be an indicator showing how effectively a company is using its capital.

So, how much ROIC is considered that the company has effectively utilized the capital invested?

The denominator of the ROIC formula is the money of lenders seeking WACC as the minimum return.

However, although lenders are looking for a return on market value, the denominator of the ROIC formula have been expressed in book value.

Therefore, if the difference between the market capitalization and the shareholders' equity as the book value is represented by α, the market capitalization can be expressed by the following formula using the shareholders' equity.

If α = 0, the market capitalization is the same as shareholders' equity.

If 0 < α, the market capitalization is larger than the shareholders' equity, and if α < 0, it is smaller than the equity.

Market capitalization = Shareholders' equity + α

Then, the formulas of WACC and ROIC can be expressed as follows.

Here, interest-bearing debt is treated as book value because the difference between book value and market value is usually small.

WACC = Re × Market capitalization + Rd × Interest-bearing debt × (1 − T) Shareholders' equity + Interest-bearing debt + α

ROIC = NOPAT Shareholders' equity + Interest-bearing debt

In addition, the numerator of the WACC formula can be expressed as the expected return amount by shareholders and creditors, and the numerator of the ROIC formula can be expressed as the hurdle return amount that the company should output.

Expected return amount here is a paraphrase of the amount of return that shareholders and creditors demand from the company with respect to the total amount of market capitalization and interest-bearing debt.

WACC = Expected return amount Shareholders' equity + Interest-bearing debt + α

ROIC = Hurdle return amount Shareholders' equity + Interest-bearing debt

And, if the hurdle return amount of the ROIC formula exceeds the expected return amount of the WACC formula, it can be considerd that the company has made effectively use the capital.

Therefore, in order to compare the respective returns, these formulas are transformed into the following forms.

Expected return amount = WACC × (Shareholders' equity + Interest-bearing debt + α)

Hurdle return amount = ROIC × (Shareholders' equity + Interest-bearing debt)

And if the hurdle return amount is larger than the expected return amount, that is, if the following formula is satisfied, the company can be considered to have made effective use of its capital.

Hurdle return amount − Expected return amount =

(ROIC − WACC) × (Shareholders' equity + Interest-bearing debt) − α × WACC

>

0

That is,

(ROIC − WACC) × (Shareholders' equity + Interest-bearing debt)

>

α × WACC

・・・ (1)

When α = 0, that is, when shareholders' equity and market capitalization are the same, the right side of the inequality becomes 0.

Therefore, if ROIC > WACC, it is considered that the company has been able to effectively use the capital.

On the other hand, when 0 < α, that is, when the market capitalization is larger than shareholders' equity, the right side of the inequality takes a positive value.

Therefore, when 0 < α, ROIC must be large to some extent relative to WACC to satisfy the inequality.

This can be seen from the fact that the expected return amount is affected by the market capitalization of stocks.

If 0 < α, the expected return amount will increase.

Expected return amount = WACC × (Shareholders' equity + Interest-bearing debt + α)

Looking back at the WACC formula shown below, 0 < α means that the ratio of ReE, which is the expected return amount of shareholders, increases with respect to the ratio of RdD (1-T), which is the expected return amount of creditors.

And, the expected rate of return Re of the shareholders who are the lenders of risk money is usually larger than the interest rate Rd of interest-bearing debt.

Therefore, positive α results in an increase in WACC.

WACC = Re × E E + D + Rd × D E + D × (1 − T)

In other words, in the following inequality, positive α increases the WACC to make the left side smaller and the right side larger.

In addition, the larger α, the larger the right side of the inequality.

These things indicate that the higher the market capitalization of a stock, the higher the hurdle for ROIC to satisfy the inequality.

In other words, if the market capitalization is large, a higher return amount, that is, NOPAT, is required with respect to the expected return amount required by shareholders and creditors.

(ROIC − WACC) × (Shareholders' equity + Interest-bearing debt) > α × WACC ・・・ (1)

By the way, WACC is the required return of shareholders and creditors, and ROIC is the result of the company's business.

And the ROIC, which is a result of the business, is a fact and cannot be changed.

Therefore, if ROIC cannot satisfy this inequality, it is reasonable that the stock price will play a adjusting role by the market price adjustment mechanism.

That is, it is natural that adjustments to meet inequality will be made by falling stock prices.

When the market capitalization is less than shareholders' equity, this inequality also seems to allow a lower ROIC than WACC, as α < 0 is negative on the right side.

However, as mentioned above, the price adjustment mechanism is working in the market.

It should be noted that a low ROIC will result in a smaller market capitalization than shareholders' equity, but a small market capitalization does not mean that a low ROIC will be accepted.

By rearranging the above inequalities, it can be rewritten about α as follows.

α < (ROIC − WACC)×(Shareholders' equity + Interest-bearing debt) WACC

This inequality indicates that a high ROIC can justify a high stock price, but a low ROIC cannot justify a high stock price.

It also indicates that ROIC exceeding WACC is one of the conditions for the market capitalization to be larger than shareholders' equity, that is, 0 < α.

ROIC is a concept similar to ROE, but the feature of ROIC is that the denominator includes interest-bearing debt.

Increasing the interest-bearing debt ratio is not always good for shareholders.

But, a company can raise the ROE by buying back its own shares using borrowing.

As is clear from the formula, even if borrowing increases debt and profits do not change, ROE will increase due to a decrease in shareholders' equity due to share buybacks.

This indicates that ROE has defect as an indicator of capital efficiency.

ROE = Net income Equity capital

On the other hand, the denominator of ROIC is shareholders' equity and interest-bearing debt.

Even if treasury stock is acquired and canceled by borrowing, the total amount of the denominator does not change, so the ROIC does not change.

In addition, the influence of borrowing on the cost of capital will be reflected in WACC.

ROIC also has the advantage that it can be compared with WACC.

Therefore, ROIC, which represents the rate of return on invested capital, is considered by many investers or management that it is more useful as an indicator of capital efficiency than ROE, which represents the rate of return on equity capital.

Here, an example of ROIC calculation is shown using the following income statement and balance sheet.

The unit of amount is 1 billion yen in both financial statements.

The effective tax rate is assumed to be 30%.

|

Net sales ・・・ Operating income Non-operating income Interest income 2 ・・・ Non-operating expenses Interest expenses 18 ・・・ Income before income taxes 164 ・・・ Net income ・・・ |

|

Assets ・・・ |

Liabilities Current liabilities Short-term loans payable 470 ・・・ Fixed liabilities Bonds payable 540 Long-term loans payable 200 ・・・ Total liabilities |

|

Net assets Shareholders' Equity ・・・ Total shareholders' equity 834 ・・・ Total net assets |

|

| Total assets | Total liabilities and net assets |

In the ROIC formula, the numerator is NOPAT and the denominator is the sum of shareholders' equity and interest-bearing debt, as follows.

ROIC = NOPAT 株主資本 + 有利子負債

Here it is calculated from NOPAT of the numerator to find ROIC. EBIT is calculated first because NOPAT is EBIT after tax.

EBIT is calculated by adding interest expense and subtracting interest income from net income before taxes.

Therefore, using an effective tax rate of 30%, NOPAT can be calculated as follows:

Adding units, NOPAT of this company is 126 billion yen.

Next, the denominator of the ROIC formula will be obtained. In this example, the interest-bearing debts are short-term loans, long-term loans, and Bonds payable.

Using the obtained numerator and denominator, ROIC can be calculated as follows.

Therefore, the ROIC for this example is about 6.2%.